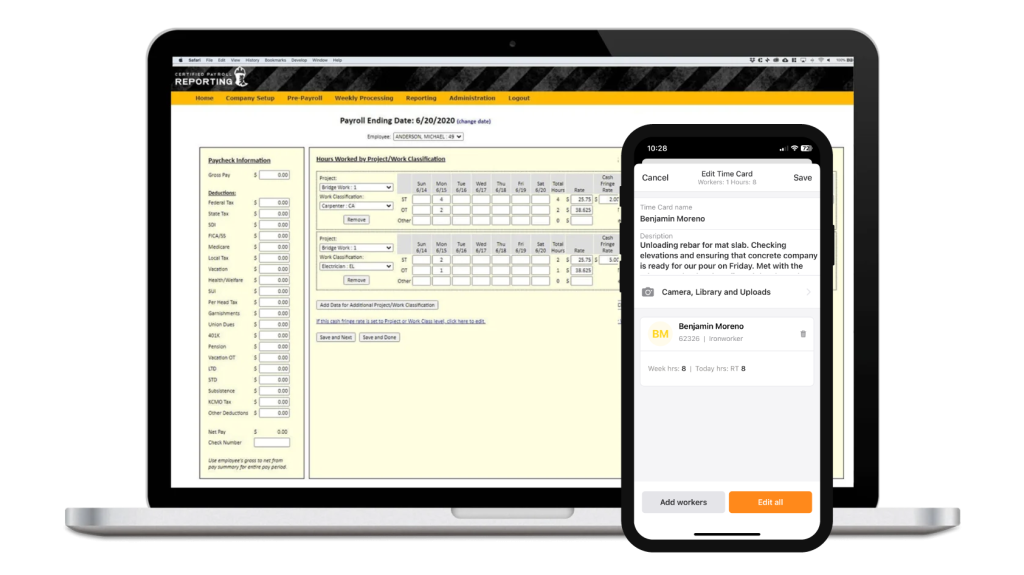

Capture and edit time cards for crews and individuals straight from the field.

Points North & Raken Software Integration

Success! Redirecting...

Collect accurate time cards

Streamline workflows

Import data directly into the Certified Payroll Reporting® system from Points North.

Generate certified payroll reports

Create certified payroll reports for federal, state, and municipal formats.