Blog

Catch up on all the latest construction tips, news, and updates.

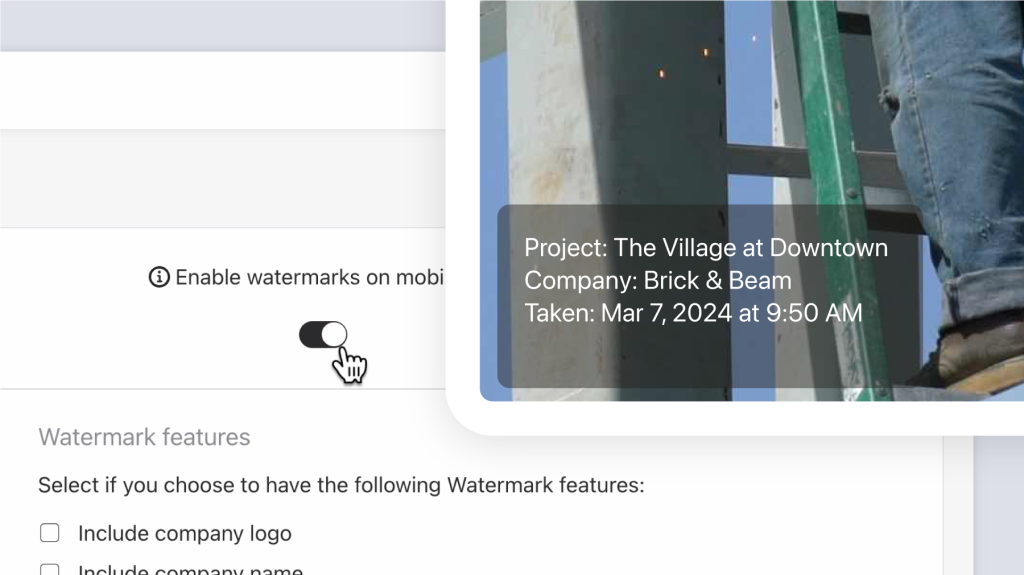

How to Enable Photo Watermarks

Learn how to add custom watermarks with your company logo, timestamps, and more to your jobsite photos in Raken’s easy-to-use field management app.

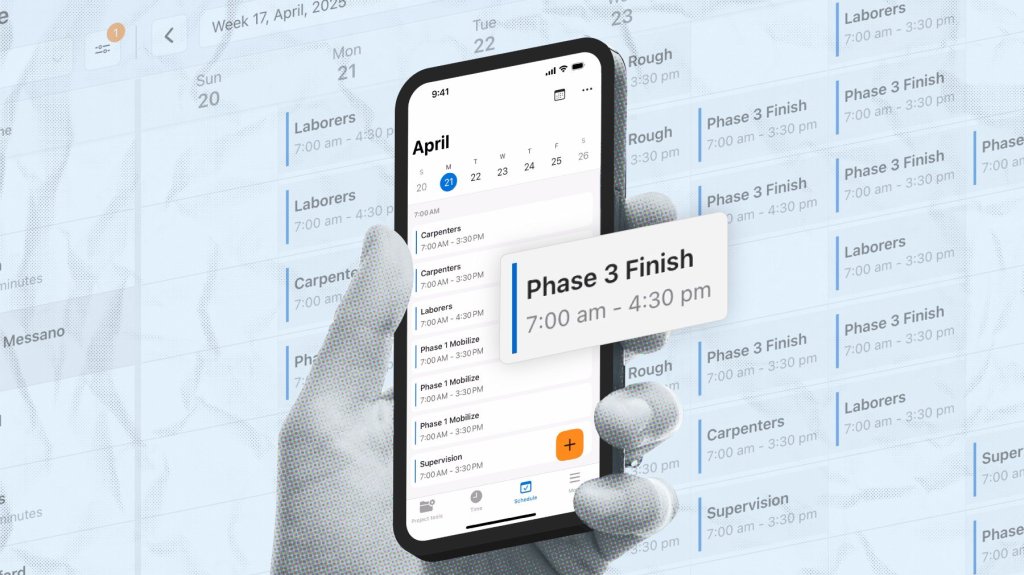

How to Better Manage Construction Crew Scheduling

Learn about the most common scheduling issues and how to manage them effectively.

Why Do I Have Too Many Change Orders?

Learn some of the most common reasons you might have more change orders than usual on a project.

5 Ways to Celebrate Construction Safety Week

Construction Safety Week is May 5-9, 2025! Learn more about this important week and explore different ways to participate.

Dealing with Difficult Weather in Construction

No matter how good you are at your job, you can’t control the weather. But, with proper planning and the right tools, you can avoid the most common issues caused by bad weather....

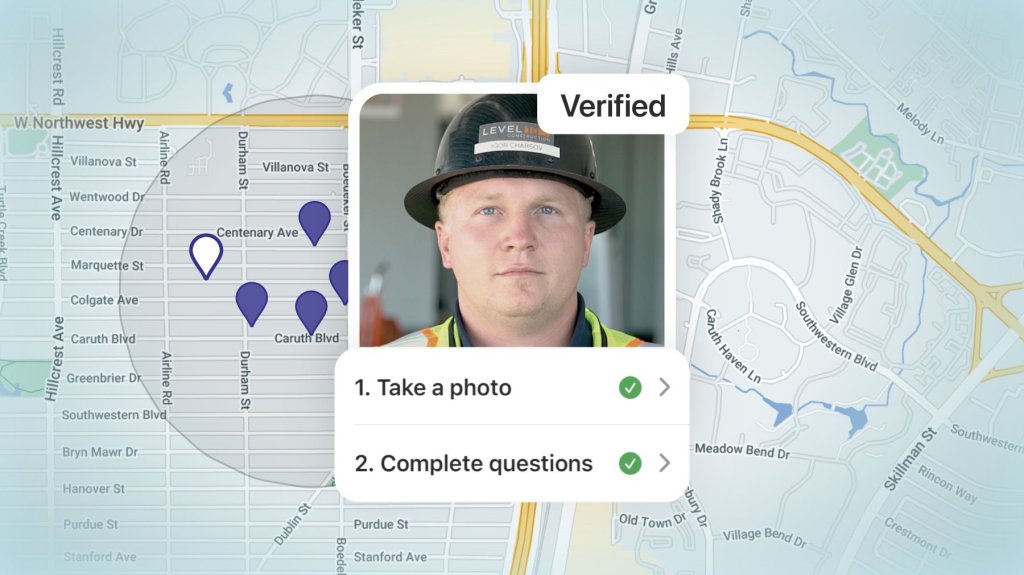

How to Prevent Time Theft

Learn how to prevent buddy punching and other types of time theft with Raken.

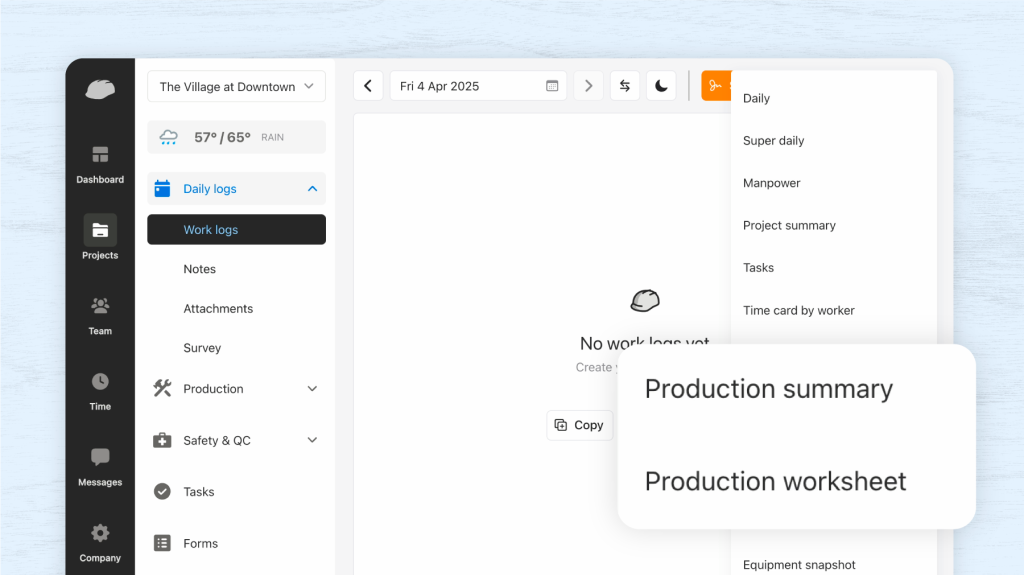

How to Run New Production Reports

Learn more about Raken's newest reports that combine details on labor, materials, and equipment.

5 Ways to Celebrate National Work Zone Awareness Week

Learn more about National Work Zone Awareness Week and how you can participate!

Quarterly Update: Check Out Our New Releases

There is a lot happening at Raken, with new features, integrations, and enhancements to get excited about.

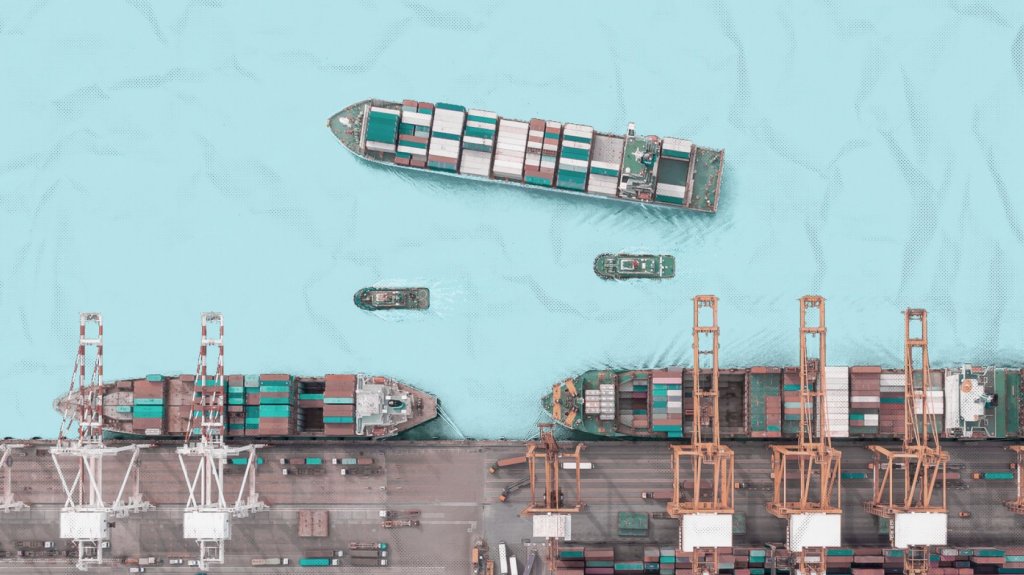

How Will Tariffs Affect My Construction Business?

Learn how to prepare your construction business for potential rising costs due to new tariffs on steel, aluminum, and other imported materials.

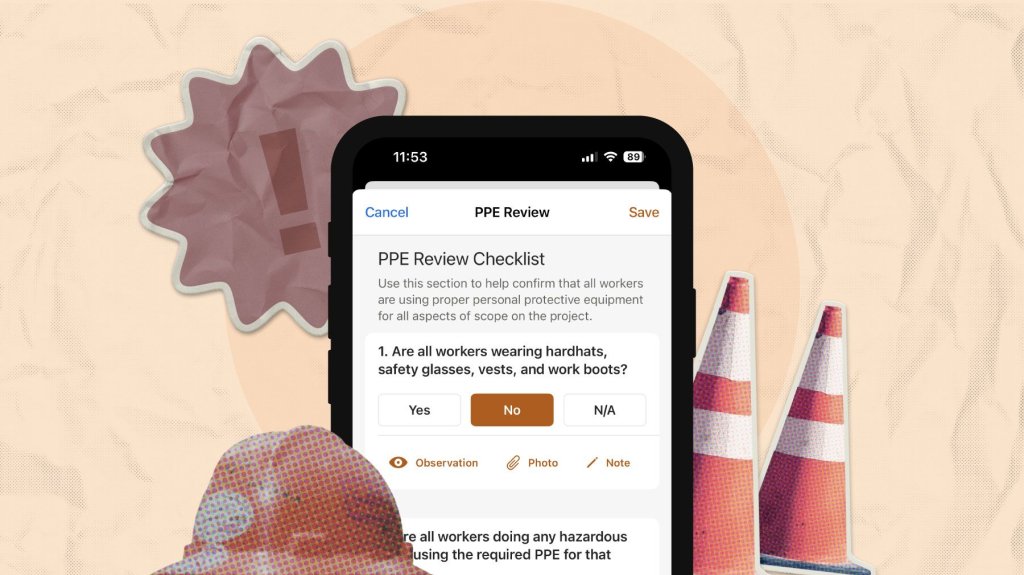

5 Reasons Why Employees Don’t Take Safety Seriously

Explore some of the reasons why workers don't always follow best safety practices on the jobsite.

What is an RFI in Construction? A Contractor's Guide

Learn how to write and submit an RFI in construction.