Blog

Catch up on all the latest construction tips, news, and updates.

How to Use Report Segments

Raken’s segmented reports keep you organized when working on large scale projects.

2025 Year-End Update: Blazing New Trails

We unveiled new features, integrations, and updates throughout the year, so check out what’s new.

How to Connect Raken with OSHA’s Injury Tracking Application

Raken can make submitting your yearly injury and illness data to OSHA as easy as clicking a button.

Top User Form Templates in Raken

See what kind of form templates users are creating in the Raken app to make sharing and accessing documentation much easier from the construction site.

An Intro to AI in Construction

We explore common AI construction tools and how your business can benefit from adopting them.

How to Schedule Shifts

Schedule one-off or recurring shifts on the go with Raken’s flexible resource scheduling tools.

Plan for a Better 2026 in Construction

It’s the perfect time to start planning for next year’s construction projects. Learn how Raken can help save time and improve productivity in 2026.

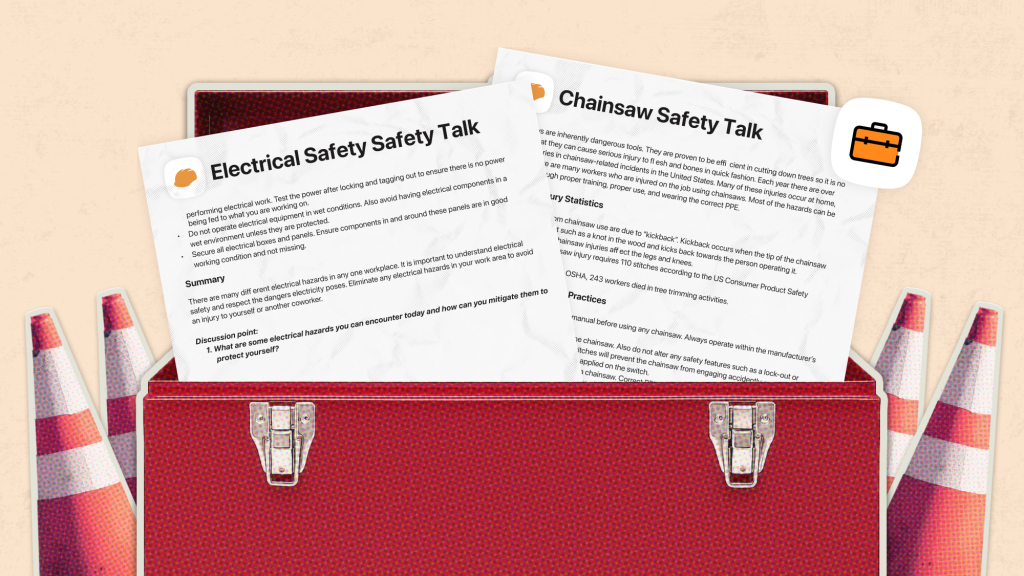

How to Deliver More Effective Toolbox Talks

Toolbox talks are an easy way to improve jobsite safety, but how do you make sure your teams actually pay attention?

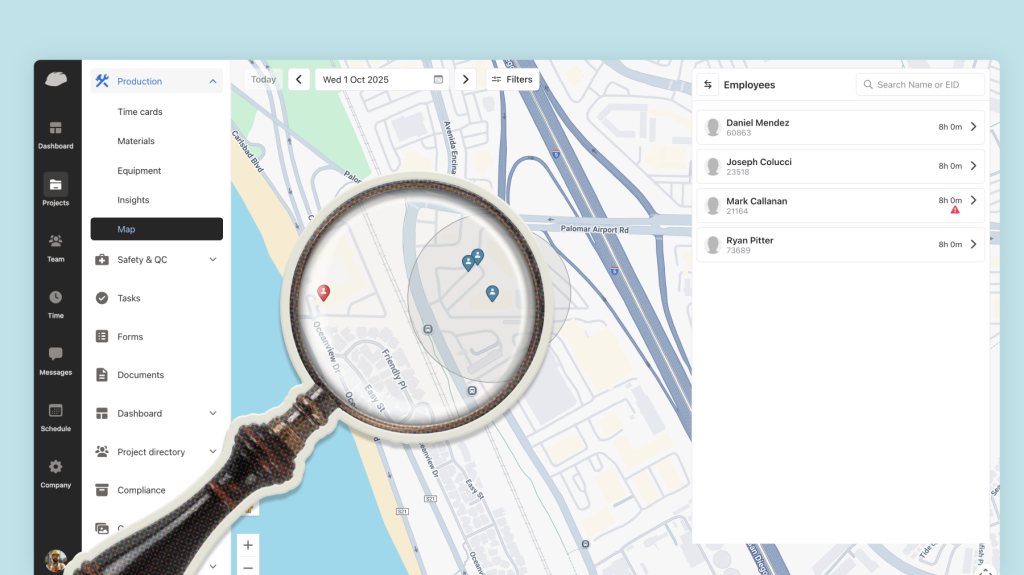

Setting Up Geofencing for Raken Time Clock

Reduce time theft and ensure compliance with your time tracking policies by enabling geofencing for Raken’s mobile time clock app.

Why Do Construction Projects Go Over Budget?

Even with careful planning, many construction projects run over budget. Read the common reasons why and learn how to prevent cost overruns.

Quarterly Update: Enhanced time and production tracking

As a versatile all-in-one tool for the field, we’re always looking for ways to improve and expand our capabilities. We did a lot of that during the third quarter of the year,...

What is Modular Construction and is it Right for Me?

Learn more about this building method and why it's gaining popularity.